what is a real property tax levy

Almost every town collects and. Levies are different from liens.

The IRS can garnish wages take money from your bank account seize your property.

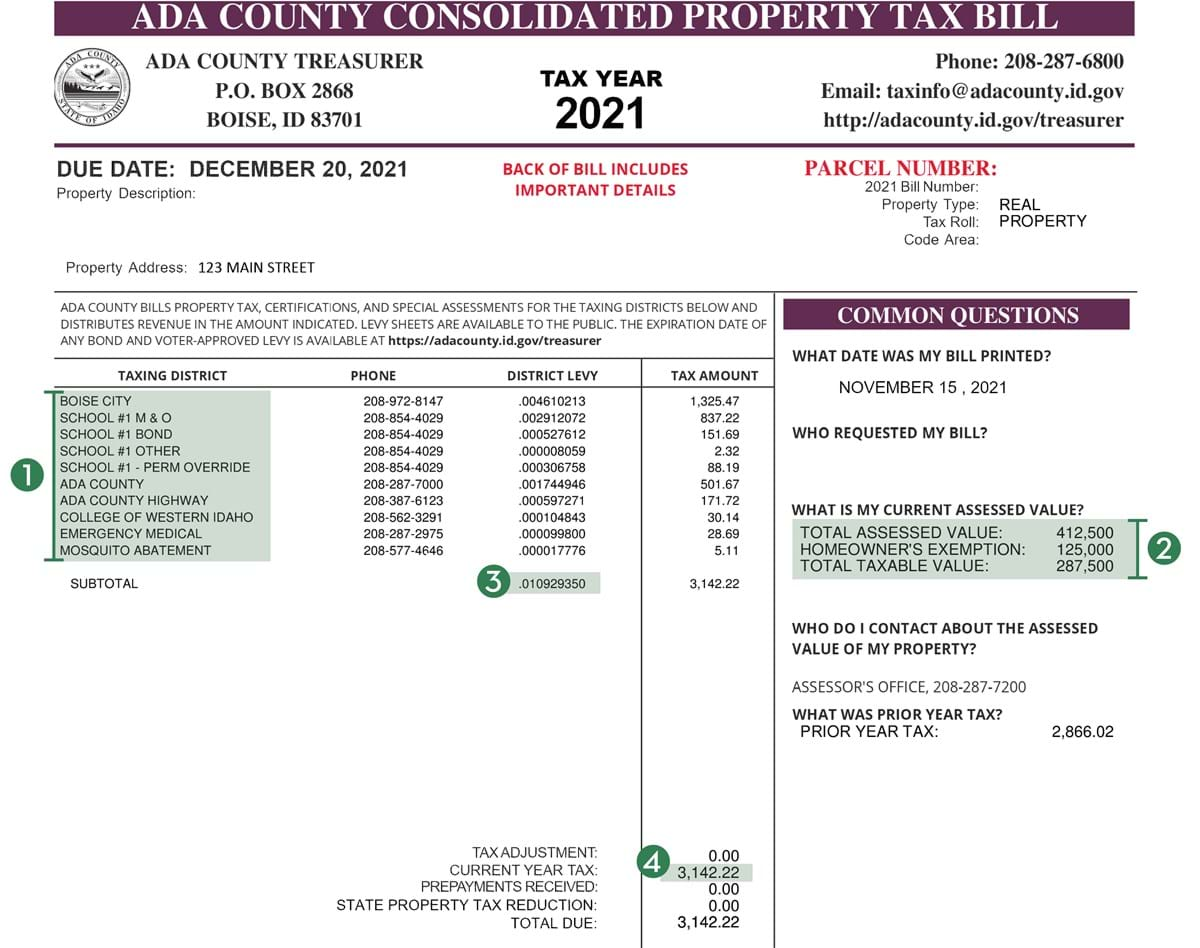

. Each unit then gets the assessed amount it levied. X SEF levy Php28000. What Is a Property Tax Levy.

Credit reporting agencies may find the notice of federal tax lien and include it in your credit report. A levy is a legal seizure of your property to satisfy a. There are three vital steps in taxing property ie formulating mill rates estimating property market worth and taking in tax revenues.

The LPT rate is set by central government at 018 for properties valued up to 1m and 025 on the portion of the value above 1m. It only happens in cases where you have failed to pay your taxes and set up some agreement with the. Property tax is a tax assessed on real estate.

Almost all property taxes are levied on real property which is legally defined and classified by the state apparatus. Property taxes are calculated by multiplying the assessed value by the mill rate and dividing by 1000. A tax levy is when the IRS takes property or assets to cover an outstanding tax bill.

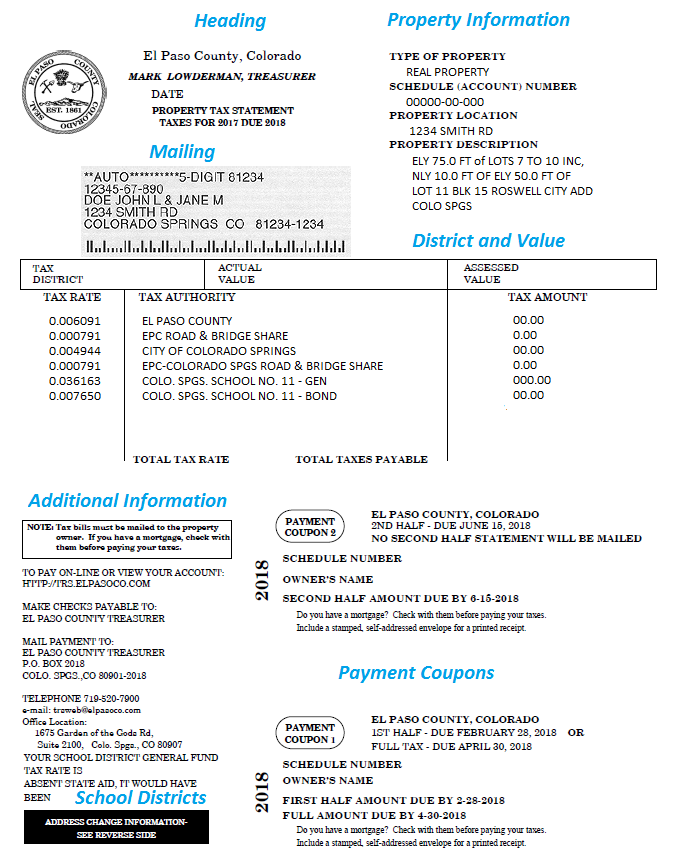

RPT RPT rate x assessed value. Real property includes the land structures or other fixed. A tax rate is the percentage used to determine how much a property taxpayer will pay per one hundred dollars of net assessed.

A levy is a legal seizure of your property to satisfy a tax debt. Put Real Estates Unfair Advantages to Work for Your Portfolio Become a member of Real Estate Winners and learn how you can start earning institutional-quality returns with less. To get the real property tax computation use this formula.

Credit reporting agencies may find the notice of federal tax lien and include it in your credit report. A tax levy is a collection procedure used by the IRS and other tax authorities such as the state treasury or bank to settle a tax debt that you owe to them. Mill Levy or Millage.

An assessment mill levy is a tax on real property assessed at 1000. Property tax is a tax obligation imposed on homeowners as a result of their ownership of real estate. A levy is a legal seizure of your property to satisfy a.

A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes. What is the difference between a tax rate and a tax levy. A mill levy or mill tax is a property tax based on the assessed value of real estate.

If payment is made before the due date the tax payer is granted up to 20 of the. Remember that the RPT rate in Metro Manila is 2 and for provinces it is 1. These taxes are typically used by local governments to allocate funding for school districts or.

Real property tax is paid annually on or before 31 March 4 quarterly installments or in advance. Credit reporting agencies may find the Notice of Federal Tax Lien and include it in your credit report. Levy County Tax Collector Michele Langford CFC.

Credit reporting agencies may find the notice of federal tax lien and include it in your credit report. A levy is a legal seizure of your property to satisfy a. Property Taxes Search andor Pay Property Tax On-line To start a search choose the Property Tax button on the left.

A lien is a legal claim against property to secure payment of the tax debt while a. A levy is a legal seizure of your property to satisfy a tax debt. However individual councils have the power.

Joyce Albany County Office Building 112 State St Room 1340 Albany NY 12207 Phone.

How We Got Here From There A Chronology Of Indiana Property Tax Laws

The Property Tax Annual Cycle In Washington State Myticor

/https://static.texastribune.org/media/images/PropertyTax.jpg)

Analysis Cutting A Tax The State Does Not Levy The Texas Tribune

Understanding The School Tax Levy

Nyc Real Property Tax Levy For Fiscal Year 2016 Nyc Blog Estate

Joplin Officials Discuss Property Levy Tax Koam

Real Property Taxes In Europe European Property Tax Rankings

Property Taxes Hennepin County

Chart 50 Highest Real Estate Tax Levies By Kentucky School Districts 89 3 Wfpl News Louisville

Understanding Your Property Tax Statement Cass County Nd

Property Taxes City Of Evanston

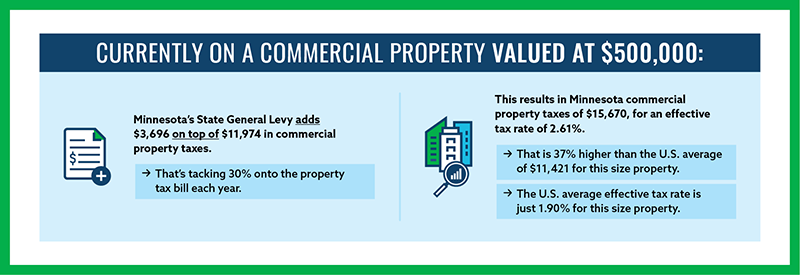

Report Minnesota S Tax On Ci Properties

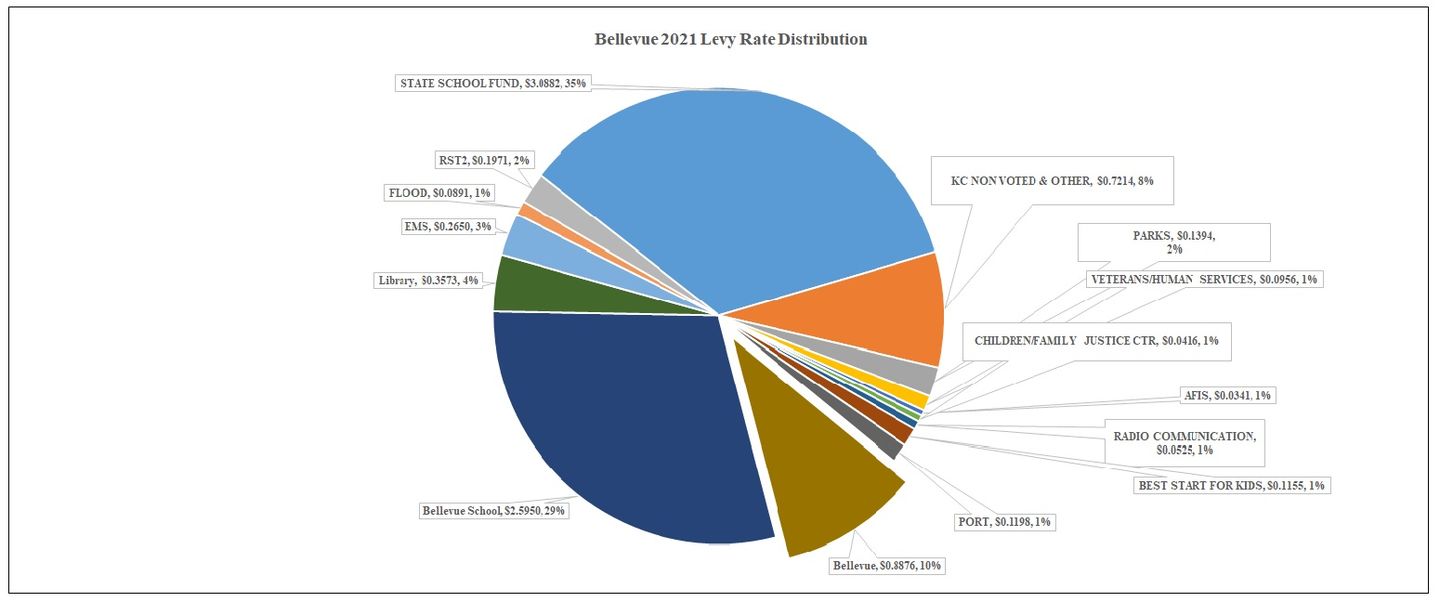

Bellevue Property Taxes City Of Bellevue

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum